Transforming Health Claims Settlement in India

The National Health Claims Exchange (NHCX) is reshaping healthcare in India. This new system, created by the National Health Authority (NHA) and the Insurance Regulatory and Development Authority of India (IRDAI), is part of the Ayushman Bharat Digital Mission (ABDM). The NHCX aims to make health insurance claims more efficient and transparent for everyone involved.

Know more about Ayushman Bharat Digital Mission

Current Claim Processing System

The current health insurance claim process in India is often complicated:

1. When patients receive hospital treatment, they must provide their insurance details or a card from a Third Party Administrator (TPA) or insurance company. Pradhan Mantri Jan Arogya Yojana (PMJAY) beneficiaries use a card from the State Health Agency (SHA).

2. Hospitals then use different claim processing portals to upload necessary documents for approval. This process varies depending on the policy or scheme.

3. The SHA, insurance company, or TPA then checks and digitizes the forms using their own systems. Much of this checking is done manually in India, unlike in many developed countries where computers handle most claims.

Challenges in the Current System

The current system faces several problems:

• No standard way to share claim information, leading to the use of outdated methods like PDFs and manual data transfers.

• Different insurers, TPAs, and healthcare providers use different health protocols.

• Claim submission and approval processes vary greatly among different parties, causing confusion and delays.

To address these issues, the NHA and industry experts have created standard guidelines for Health Claims Data Exchange. These guidelines aim to create a unified system for processing claims that works for all parties and encourages technological progress.

The National Health Claims Exchange (NHCX)

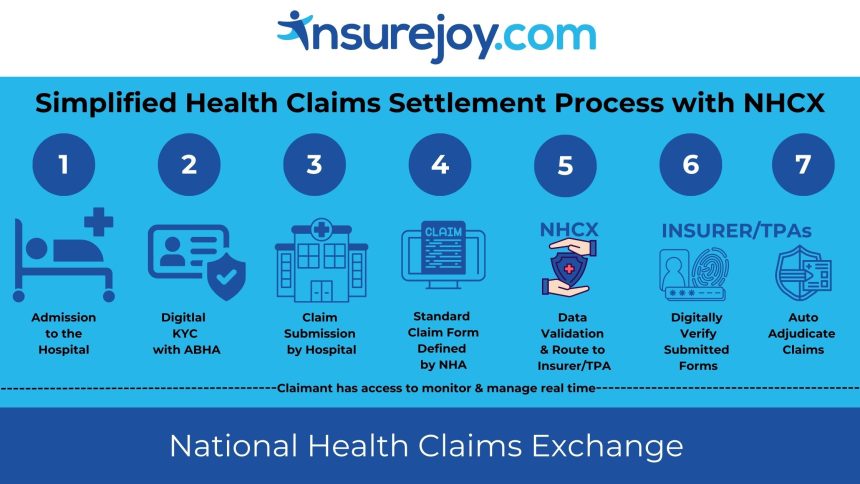

The NHCX is set to greatly improve health insurance claims:

Purpose: The NHCX is a central platform connecting insurance companies, hospitals, and policyholders. It aims to replace manual claims processing with a digital system, making the entire process faster and simpler.

Parties Involved:

o PAYERS – Insurance Companies/TPAs: Can use one platform for managing and settling claims efficiently.

o PROVIDERS – Hospitals and Service Providers: Can quickly send treatment details and costs for checking.

o INSURED PERSON – Policyholders: Experience an easier claims process and can easily check their claim status.

Benefits of NHCX:

o Faster Claims: By centralizing data sharing, NHCX reduces paperwork and speeds up approvals.

o Better Compatibility: Standardized data sharing reduces mistakes and delays.

o More Transparency: Policyholders can easily track their claims and access necessary information.

o Increased Efficiency: Quick settlements benefit patients, hospitals, and insurers.

Addressing Current Issues

The traditional claim process involves many steps and interactions between patients, hospitals, and insurers, making it slow and complicated. Often, patients keep waiting throughout the day for this process to be completed leading to delay in discharge from hospital and additional room rent charges. The NHCX aims to simplify this process by offering a single platform to monitor & manage claims across India.

Future Outlook

The introduction of NHCX is a significant step in digitalizing health insurance claims in India. By addressing current inefficiencies and providing a unified platform, NHCX is set to improve the overall efficiency of the healthcare system, benefiting patients, providers, and insurers alike.

So don’t worry about claims and ensure you’re sufficiently covered.

Visit for transparent health insurance solutions.